Inspector Inland Revenue Past Papers FPSC pdf books

Inspector Inland Revenue Past Papers of year 2014 have been posted below in this post.

Federal Public Service Commission is going to conduct One-Paper MCQs test for the post of FBR Inspector Inland Revenue.

We always tried our best to provide authentic guide with best preparation material to our users.

Today, we are going to upload Fpsc inspector Inland Revenue Past papers of year 2014 and 2018.

You can also download fpsc inspector inland revenue pdf book past paper in pdf.

Download FPSC Inspector Inland Revenue pdf books

Download Fpsc inspector inland revenue 2018 past paper

DOWNLOAD FPSC Model Papers pdf book by Advanced Publishers

INSPECTOR INLAND REVENUE Paper 2014 (PART-II)

PROFESSIONAL TEST

1. Pakistan Fiscal year starts from

a) 1st September

b) 1st January

c) 1st April

d) 1st July

2. Which is a provincial tax in Pakistan?

a) Excise tax

b) Sales Tax

c) Import Duty

d) Motors token tax

3. There is how many chapters are included in Income Tax Ordinance?

a) 11 Chapters

b) 12. Chapters

c) 13 Chapters

d) 14 Chapters

4. There is how many schedules are included in Income Tax Ordinance 2001?

a) 9 Schedules

b) 6 Schedules

c) 7 Schedules

d) 8 Schedules

5. There is how many sections are included in Income Tax Ordinance 2001?

a) 235 sections

b) 240 sections

c) 250 sections

d) 260 sections

6. Corporate tax is levied on:

a) Landlords

b) Municipal corporation

c) Joint-stock companies

d) Importers

7. Central Excise Act, 1944 was repealed By.

a) The Federal Excise Act, 2002

b) The federal Excise Act, 2004

c) The Federal Excise Act, 2005

d) The Federal Excise Act, 2007

8. The name of Central Excise Duty has been changed as a Federal Excise Duty on

a) 1st July 2003

b) 1st July 2005

c) 1st July 2007

d) 1st July 2008

9. Inland Revenue Wing of the FBR was created, which is a combination of domestic taxes.

a) 3 b) 4

d) 6 c) 5

10. If we deduct direct tax from personal income, we get:

a) Net national income

b) Personal saving

c) Disposable income

d) Per capita income

11. The largest part of national income is

a) Consumption

b) Investment

c) Transfer payments

d) Saving

12. We measure national income by this method:

a) Expenditure Method

b) Income Method

c) Product Method

d) All of above

13. The most important source of a government is:

a) Foreign loans

b) Taxes

c) Printing of new money

d) Sale of government

14. Property In Pakistan, taxes are levied by:

a) Prime minister of Pakistan

b) President of Pakistan

c) Federal Cabinet of ministers

d). National Assembly

15. Government finance is called

a) National Finance

b) Public finance

c) Private financed

d) Both a and b

16. A direct tax is that which:

a) is a heavy burden on the taxpayer

b) Can be directly deposited in the banks

c) Cannot be evaded

d) is paid by the person on whom it is levied In

17. Pakistan government budget is prepared by:

a) National Assembly b) President of Pakistan

c) Ministry of Finance d) State Bank of Pakistan

18. If the government increases taxes, private savings:

a) Increase

b) Decrease

c) Do not change

d) Will become zero

19. Taxes on commodities are:

a) Direct taxes

b) Indirect taxes

c) Progressive taxes

d) Proportional tax

20. Govt. Prepared its budget:

a) Weekly b) Monthly c) Annually d) Quarterly

21. It is direct tax:

a) Excise tax

b) Sale tax

c) Income tax

d) Custom duty

22. Which tax is not shared between central and provincial governments?

a) Excise tax

b) Sales tax

c) Custom duty

d) Property tax

23. Which is a provincial tax in Pakistan?

a) Excise tax

b) Sales tax

c) Import duty

d) Motor token tax

24. The budget estimate prepared by the ministry of finance is finally approved by:

a) State Bank

b) President

c) Senate.

d) National Assembly

25. Devaluation means

a) Change in the currency of a country

b) Decrease in the value of gold

c) Decrease in the value of money in terms of foreign currency

d) Decrease in the value of money internally -

26. When the central Board of Revenue (CBR) was established?

a) 1st April 1924

b) 7th April 1924

c) 6th April 1924

d) 9th April 1924

27. What is the main function of money?

a) To buy eatables from the market

b) To serve as a medium of exchange

c) To earn interest from a bank

d) To buy luxurious goods

28. A direct tax is that which:

a) is a heavy burden on taxpayers

b) Can be directly deposited in the banks

c) Cannot be evaded

d) is paid by the person on whom it is levied

29. The special procedure under the title of Sales Ta special procedure (Withholding Tax) Rules 2007 was introduced on:

a) 20th June 2007

b) 10th June 2007

c) 30th June 2007

d) 25th June 2007

30. Whom of the following propounded principles of taxation:

a) Keynes

b) Marshall

c) Adam Smith

d) Ghazaliali

31. There is how many schedules es included in the Sales Tax Act, 1990?

a) 9 schedules

b) 6 schedules

c) 7 schedules

d) 8 schedules

32. There is how many sections ns included in the Sales Tax Act, 1990?

a) 75 Sections

b) 80 sections

c) 85 sections

d) 95 sections

33. Which section of the sales tax act, 1990 deals with Special Audit by Chartered Accountants or Cost Accountants?

a) 29 b) 30

c) 31 d) 32.

34. Which Section of the Sales Tax Act, 1990 deals with offences apenaltiesies?

a) 33 b) 34

c) 35 d) 36

35. No person other than a _ shall make any deduction or reclaim input tax in respect of taxable supplies made or to be made by him.

a) Unregistered person

b) Registered person

c) Association

d) None of these

42. in Pakistan, income tax is collected by

a) Local govt

b) Provincial govt.

c) Federal govt

d) All governments

43. Sales tax in Pakistan is:

a) Direct and progressive

b) Direct and proportional

c) Indirect and progressive

d) Indirect and proportional

44. It is easy and convenient to pay:

a) Direct tax

b) Indirect tax

c) Proportional tax

d) Progressive tax

45. It is difficult to evade:

a) Direct tax

b) Indirect

c) Proportional

d) Progressive tax

46. Which tax is not shared between central and provincial governments?

a) Excise tax

b) Sales tax

c) Custom duty

d) Property tax

47. Which is a provincial tax in Pakistan?

a) Excise tax

b) Sales tax

c) Import duty

d) Motors token tax

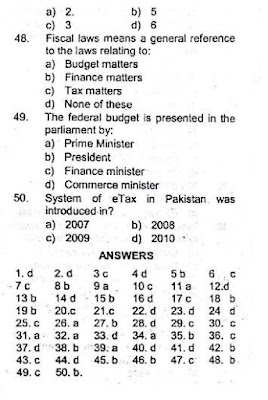

48. What is the benefit of tariffs?

a) Increased choice

b) Increased government revenue

c) More competition

d) More trade

Download ppsc Inspector inland revenue past papers solved mcqs also download pdf books of fpsc inspector inland revenue.

49. Pakistan public debt is:

a) Larger than GNP

b) Equal to GNP

c) Smaller than GNP

d) Smaller than our exports

50. Pakistan fiscal year start from

(a) 1st September (b) 1st January

(c) 1st April (d) 1st July

51. As per law each registered person must file a return by the of each month regarding the sales made in last month.

a) 10th b) 15th

c) 20th d) 25th

Fpsc inspector inland revenue past papers will be updated soon.

52. There are - director generals in FBR?

a) 6

b) 7

c) 9

d) 10

53. There are large taxpayer units 10 inland revenue collection.

Download FPSC Past Papers of different types of FPSC jobs.

Download FPSC Custom Inspector Past papers mcqs.

Solved past paper mcqs of fpsc inspector inland revenue jobs 2021

0 Comments

If you want to know other information regarding jobs kindly do comment , we will help you.